Payday lending apps are trapping Black and Latinx people in high-cost, impossible-to-repay loans.

Tell Apple to restrict these predatory apps from the App Store.

Dear friend,

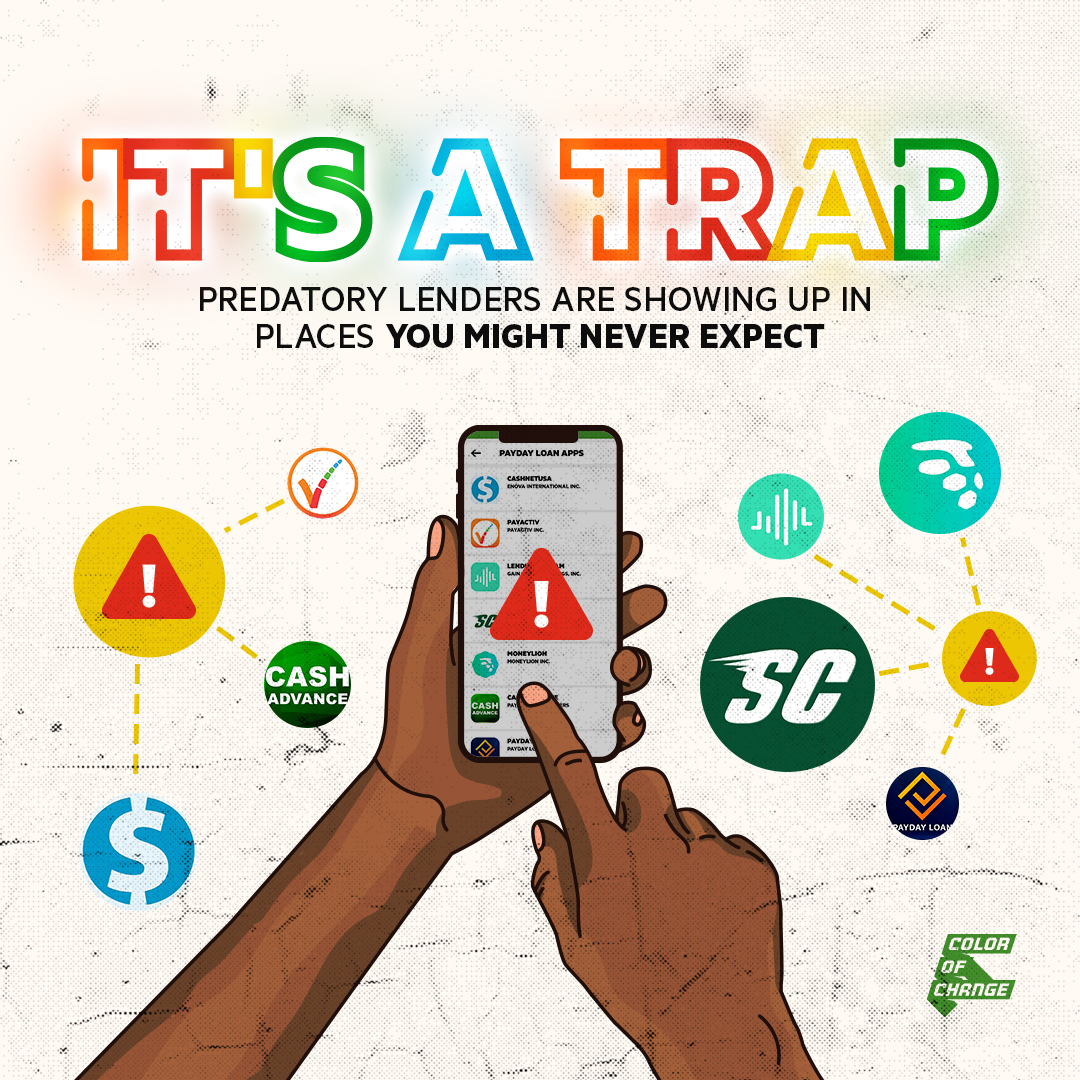

Predatory lenders are showing up in places you might never expect.

Payday lenders are no longer only providing loans through brick-and-mortar stores in Black communities. Payday lending mobile apps are experiencing a surge in popularity, and can be easily accessed through Apple’s App Store. Much like payday loan stores, payday lending apps market themselves as quick fixes for low-income people. In reality, these apps trap people in loans with outrageous interest rates and impossible payment schedules.1

Although they may seem less manipulative because they charge less than brick-and-mortar payday loan stores, payday lending apps are just as bad. Much like payday stores, these apps use loans disguised as short-term relief to trap communities of color in debt and “systematically strip wealth from low-income communities.”2 Between their high interest rates and their easy access, payday loan apps have the potential to financially destroy Black families through unmanageable terms, continual refinancing, and high default rates.3,4

Black and low-income communities turn to payday loans because they advertise that they’ll help in financial emergencies. According to USA Today, 46% of Americans cannot come up with $400 if needed for an emergency.5 Payday lenders take advantage of our families’ most vulnerable moments to provide high-cost loans that, over time, widen the wealth gap between Black and white families.6 We must put a stop to these immoral practices.

As a Color Of Change member, you’ve supported us over the years as we’ve fought against payday lenders’ harmful practices. But the popularity of payday lending apps shows us that our work is far from over. Tech leaders like Google and Facebook have already taken steps to prohibit payday lending stores from advertising on their platforms. We want to see Apple step up and join this impactful work. If Apple restricts payday lending apps from appearing in the App Store, they can help to protect families of color and low-income people from being trapped in lifelong debt.

Until justice is real,

Brandi, Rashad, Arisha, Jade, Johnny, Future, Amanda, Evan, Imani, Samantha, Eesha, Marcus, FolaSade, and the rest of the Color Of Change team

References :

- “Help stop payday predators,” ActBlue, https://act.colorofchange.org/go/222871?t=7&akid=39717%2E1942551%2EzuQhDM

- “Lawmakers should not let predatory lenders do even more damage to poor Floridians,” Miami Herald, February 6, 2018, https://act.colorofchange.org/go/145801?t=9&akid=39717%2E1942551%2EzuQhDM

- “Best 10 apps for payday loans,” AppGroves, February 24, 2019, https://act.colorofchange.org/go/222872?t=11&akid=39717%2E1942551%2EzuQhDM

- “Lawmakers should not let predatory lenders do even more damage to poor Floridians,” Miami Herald, February 6, 2018, https://act.colorofchange.org/go/145801?t=13&akid=39717%2E1942551%2EzuQhDM.

- “Why half of Americans can’t come up with $400 in an emergency,” USA Today, October 6, 2017, https://act.colorofchange.org/go/37760?t=15&akid=39717%2E1942551%2EzuQhDM

- “Lawmakers should not let predatory lenders do even more damage to poor Floridians,” Miami Herald, February 6, 2018, https://act.colorofchange.org/go/145801?t=17&akid=39717%2E1942551%2EzuQhDM

Color Of Change is building a movement to elevate the voices of Black folks and our allies, and win real social and political change. Help keep our movement strong.

Aucun commentaire:

Enregistrer un commentaire