|

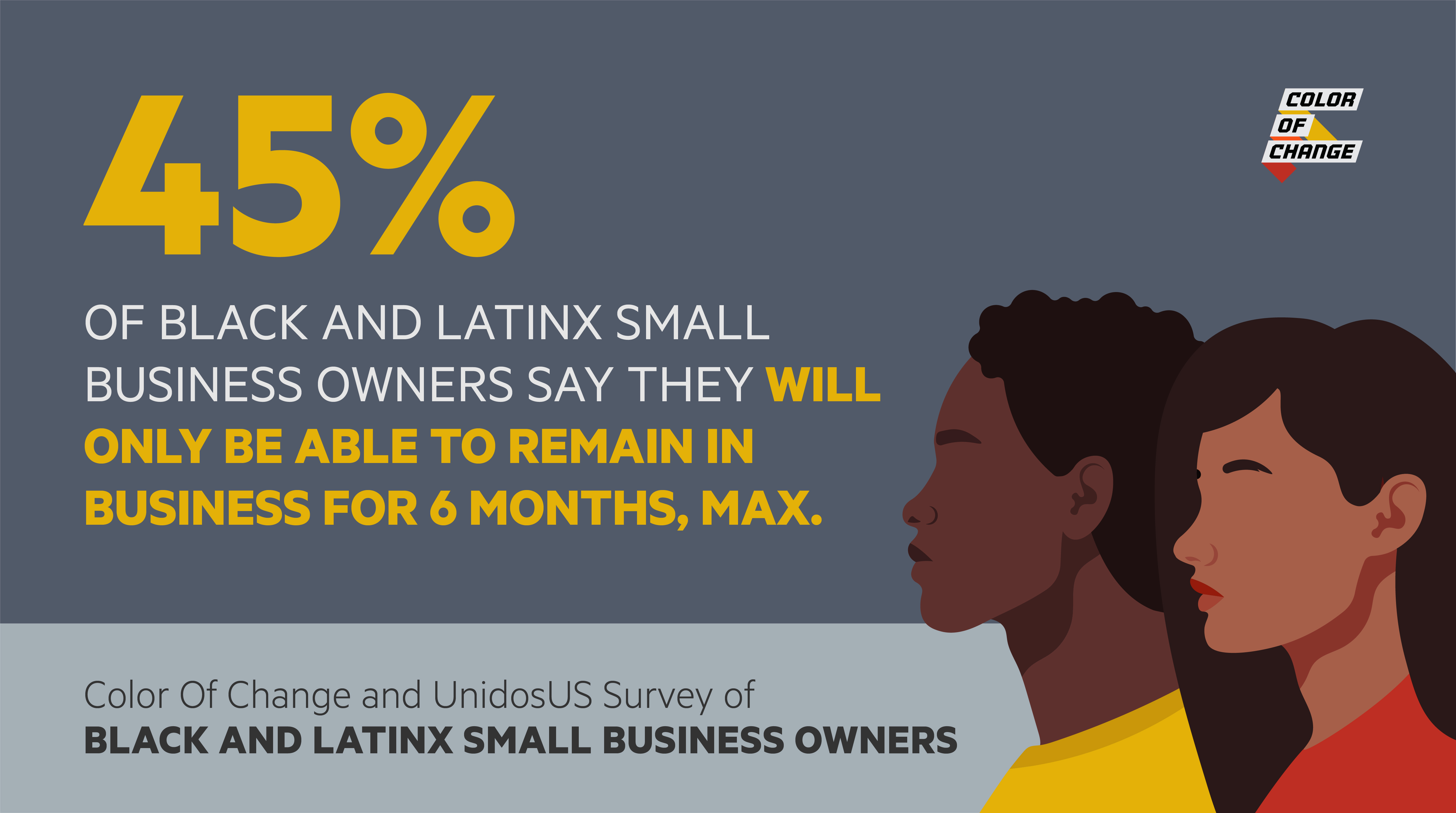

Nearly half of all Black-owned businesses will be gone in six months. Yes you read that correctly; many Black-owned businesses will be forced to close their doors due to the COVID-19 pandemic.1 The House of Representatives is currently working on adjustments to the Paycheck Protection Program (PPP) that will provide additional financial relief for small business owners. These kinds of changes could save small businesses by distributing additional loan funds, providing loan forgiveness, giving additional time for business owners to spend relief funds, and removing restrictions that have been preventing small businesses from being eligible for loan forgiveness.2 But we must ensure that these adjustments include specific provisions and protections for Black and Latinx-owned businesses.

The PPP as it’s written isn’t working. Black and Latinx small business owners’ needs were essentially ignored. Despite the majority of Black and Latinx business owners asking for less than $20,000 in assistance, only about 12% received the assistance they requested--even though Politico reports that “more than $100 billion remains available for loan approvals.”3 4 This kind of discrimination is why Congress must include measures that specifically address the needs of Black and Latinx-owned businesses.

The current proposed changes to the PPP still may not be enough to keep Black-owned businesses operating. Although revising the PPP is a step in the right direction, we need legislation that provides funds and benefits for a greater number of small business owners without strings attached. Legislation like the Paycheck Recovery Act, for example, provides an opportunity for small businesses who apply to receive an initial three-month lump sum grant payment. This would allow many more Black and Latinx small business owners to make up some of the revenue they’ve lost due to the pandemic and cover business operating costs like paying employees’ salaries.5

Without specific measures like the ones the Paycheck Recovery Act provides, we will lose not just our businesses, but all of the support and compassion they bring to our communities. The stakes are too high in this unprecedented time to leave our voices unheard. Call your representative NOW and demand Congress include specific relief measures for Black-owned businesses in their updates to the PPP.

Until justice is real,

Rashad and the rest of the Color Of Change team.

References :

- “Few Minority-Owned Businesses Got Relief Loans They Asked For,” The New York Times, May 18, 2020, https://act.colorofchange.org/go/247748?t=7&akid=42765%2E1942551%2EdzbyQ3

- “Pelosi moving to revamp small business rescue program,” Politico, May 19, 2020, https://act.colorofchange.org/go/247749?t=9&akid=42765%2E1942551%2EdzbyQ3

- “Federal Stimulus Survey Findings,” The Black Response, May 13, 2020, https://act.colorofchange.org/go/247750?t=11&akid=42765%2E1942551%2EdzbyQ3

- “Pelosi moving to revamp small business rescue program,” Politico, May 19, 2020, https://act.colorofchange.org/go/247749?t=13&akid=42765%2E1942551%2EdzbyQ3

- “H.R. 6918 - The Paycheck Recovery Act : Stopping Mass Unemployment While Supporting Businesses and Their Workers,”Jayapal.House.Gov, May 19, 2020, http://act.colorofchange.org/go/247751?t=15&akid=42765%2E1942551%2EdzbyQ3

Color Of Change is building a movement to elevate the voices of Black folks and our allies, and win real social and political change. Help keep our movement strong.

Aucun commentaire:

Enregistrer un commentaire